Recommended citation format: Paulson, N., G. Schnitkey, C. Zulauf and J. Baltz. "Information for Setting 2024 Cash Rents." farmdoc daily ( 13 ): 160, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 5, 2023. Permalink

The National Agricultural Statistics Service (NASS) recently released state and county rents for 2023. The Illinois Society of Professional Farm Managers and Rural Appraisers released their projections of 2024 rents on professionally managed farmland. Overall, cash rents increased from 2022 to 2023. Results from the Illinois Society survey suggest that cash rents may decline slightly from 2023 to 2024.

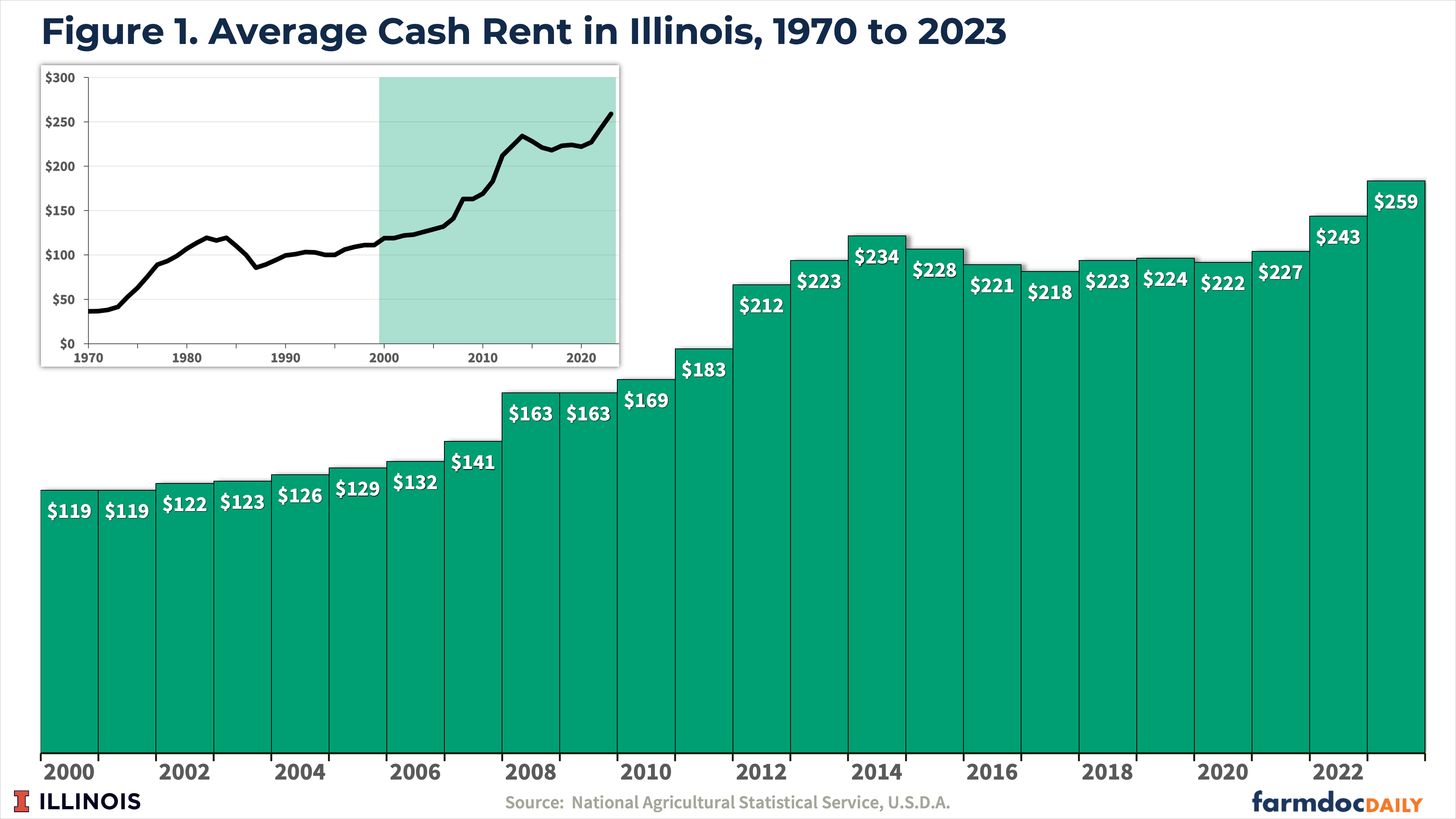

The National Agricultural Statistics Service (NASS) reported the average cash rent for Illinois in 2023 at $259 per acre, up by $16 per acre from the 2022 level of $243 per acre (see Figure 1). The 2023 rent is another new record for Illinois, after the average in 2022 surpassed the previous high of $234 set in in 2013.

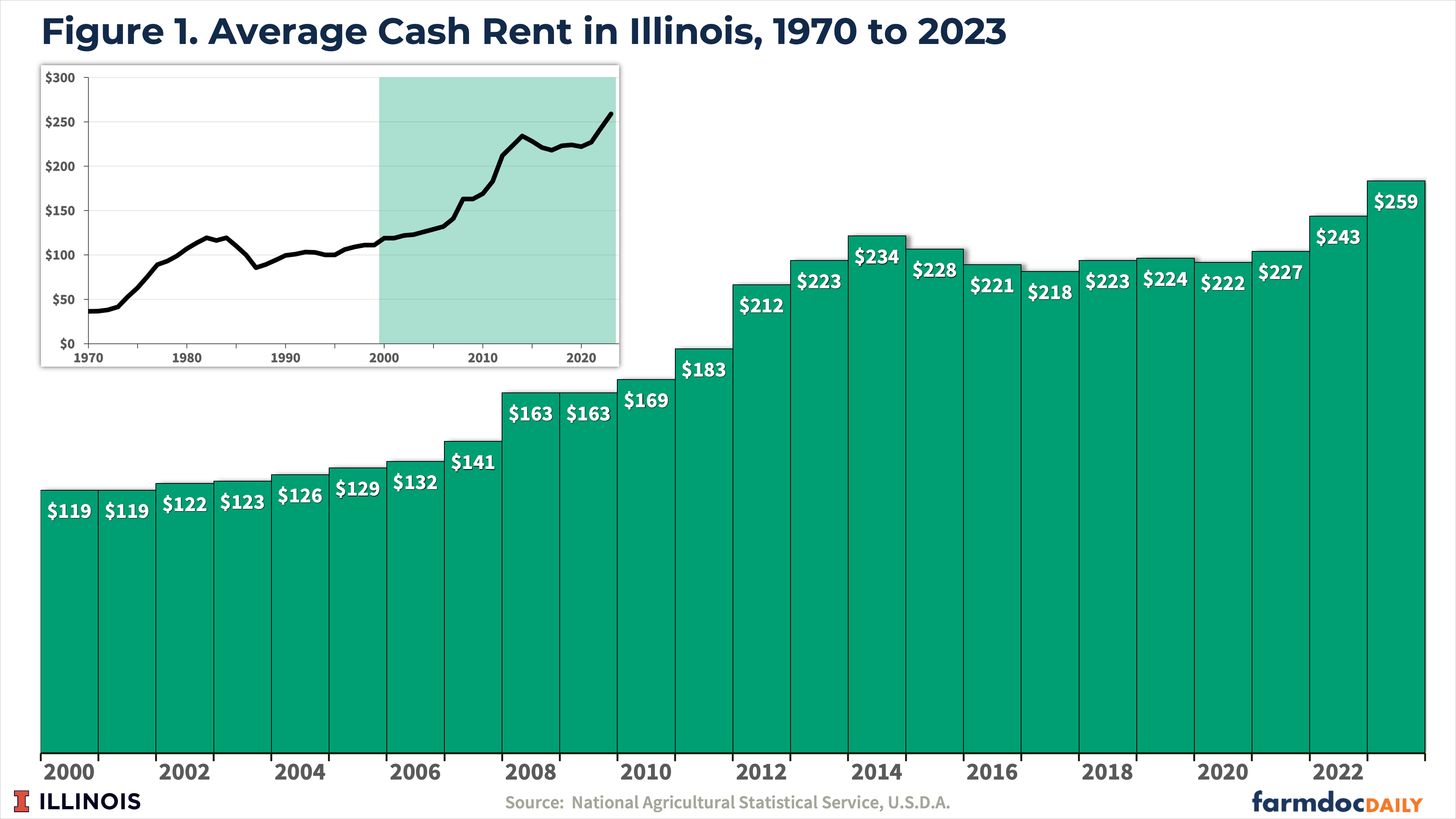

Cash rents vary across Illinois, as illustrated in Figure 2, which shows average county cash rents for non-irrigated cropland released by NASS on August 27. This year, NASS did not report cash rents for some major agricultural counties in Illinois. In Figure 2, rents for unreported counties were estimated based on a regression analysis, discussed below, relating rent levels to a county-level soil productivity index with agricultural district adjustment factors.

As is typical, cash rents are the highest in the central part of the state while cash rents are lower in southern Illinois. The highest reported average cash rent for 2023 is $367 per acre for Moultrie County. The second highest average rent is $362 for Piatt County. Moultrie and Piatt are adjacent counties in central Illinois and tied for the highest cash rent levels in Illinois in 2022 ($331 per acre). The lowest cash rent reported for 2023 is $58 per acre in Johnson County, a county in southern Illinois which also had the lowest rent reported for 2022 ($53 per acre). See farmdoc daily from September 13, 2022 for last year’s average cash rent analysis.

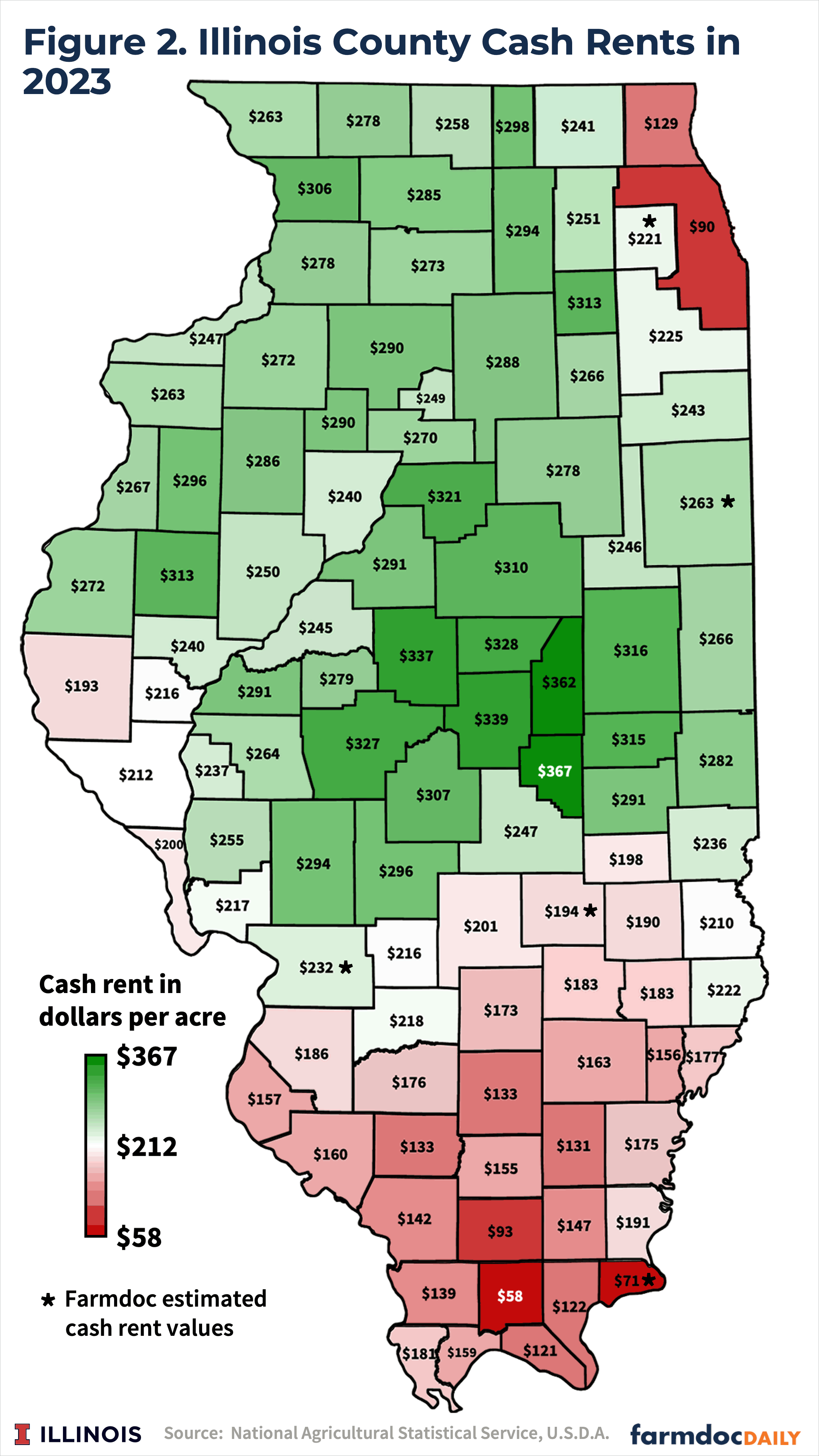

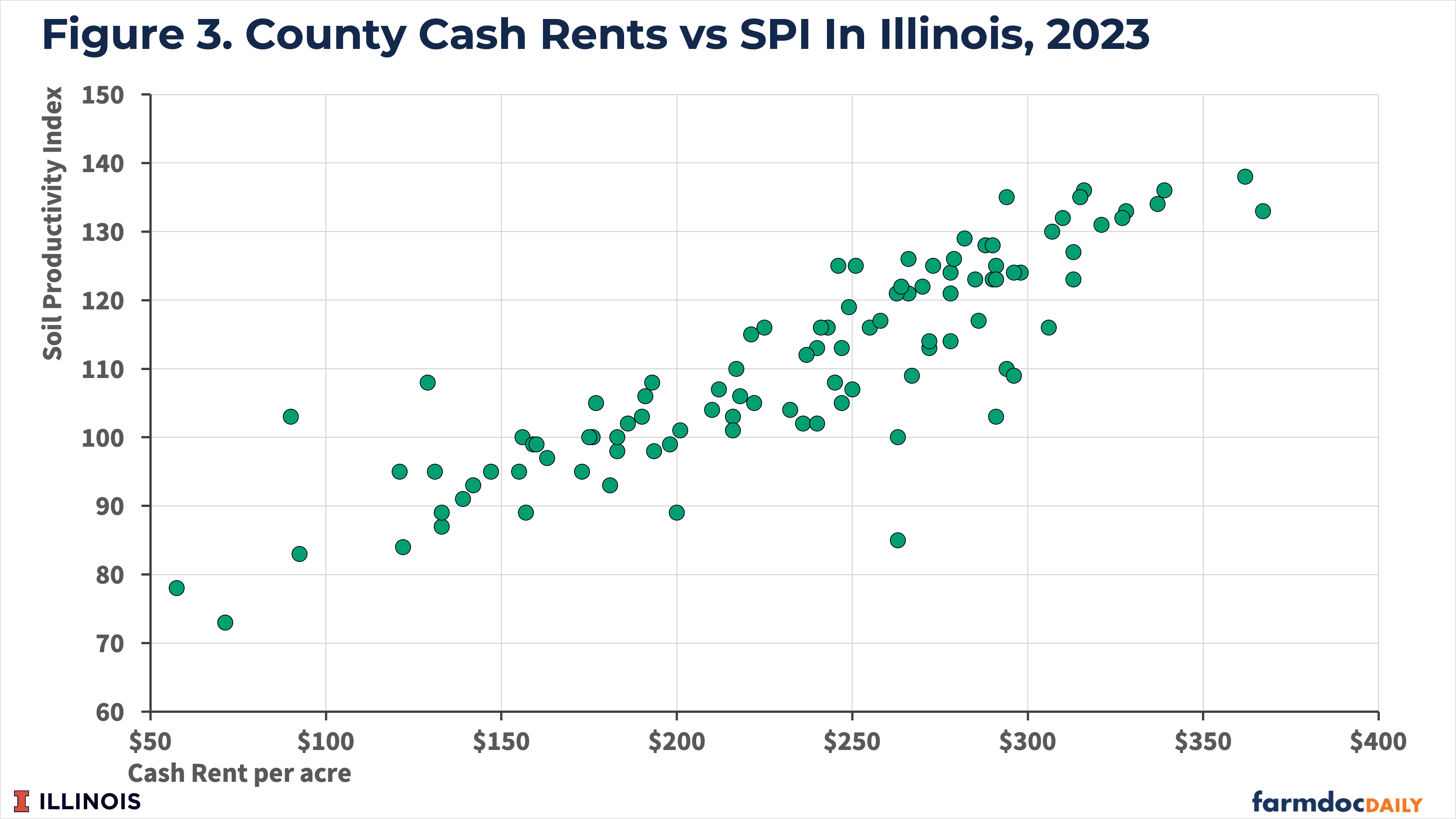

Differences in soil productivity explain a large part of the variations in county-level cash rents. Figure 3 shows a scatter graph of average 2023 county cash rents related to the average county soil productivity index (SPI). The SPI is published for Illinois soils by the Department of Natural Resources and Environmental Science at the University of Illinois (click here for more information).

Higher SPIs are correlated with higher yields and higher cash rent levels. Figure 3 shows the average county SPI and average 2023 cash rents, with the two series having a strong, positive correlation coefficient of 0.86. Higher SPIs tend to be located in central and northern Illinois (see farmdoc daily, November 7, 2017 for a map).

The SPI of farms within a county can vary from the county average. Based on the above relationship, an “average” cash rent projection for a farm in a particular county can be calculated with the following equation, which is updated based on the 2023 rent data from USDA (see farmdoc daily, November 7, 2017 for a discussion):

“Average” cash rent = -181.5 + (3.46 x SPI) + CRD adjustment

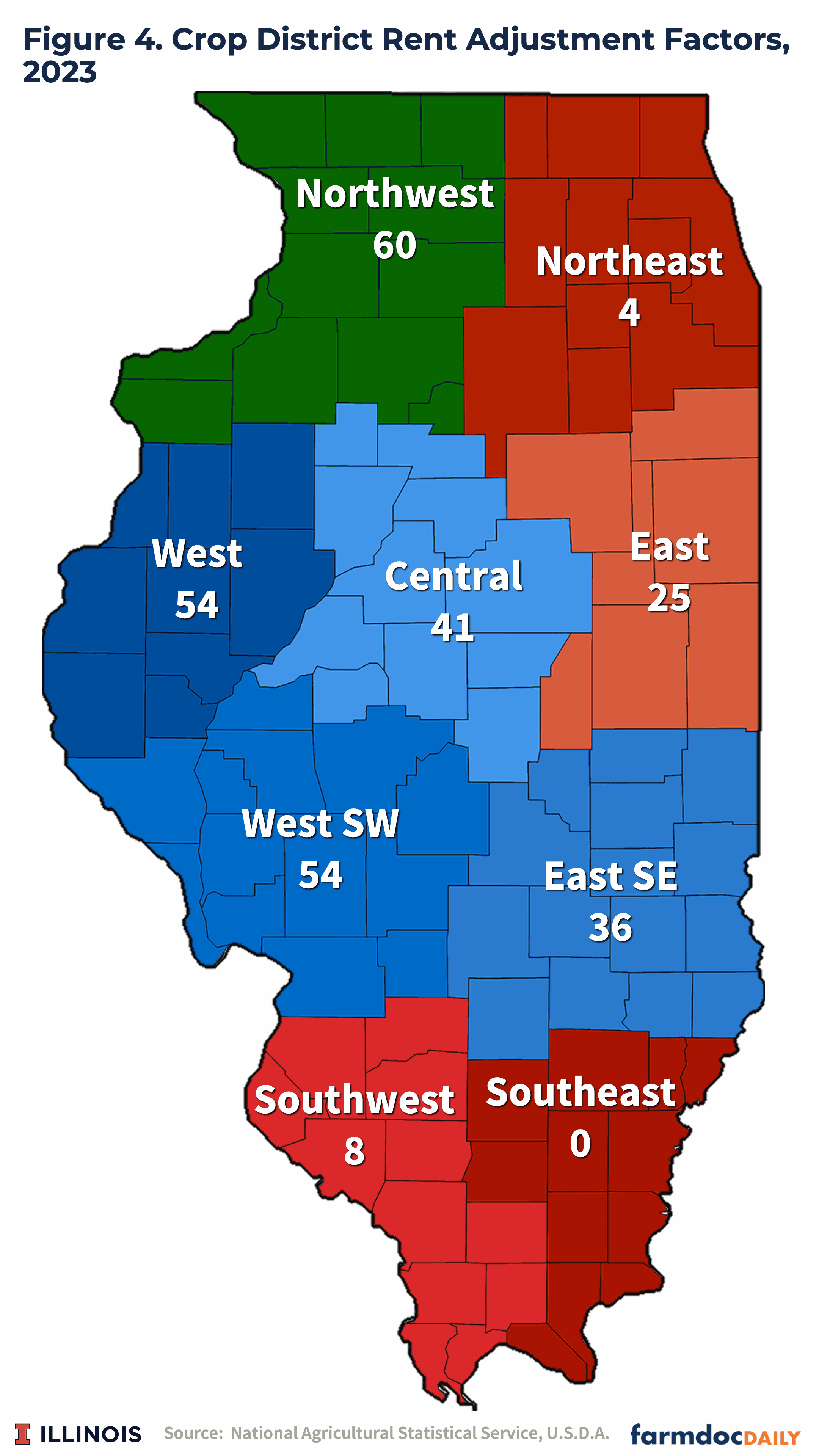

where CRD is the crop reporting district. The 2023 estimated CRD adjustment values are shown in Figure 4.

To illustrate, take a farm with a 130 SPI located in Champaign County. Champaign County is in the East CRD which has an estimated adjustment factor of $25 (see Figure 4). Given this information, an estimate for an appropriate cash rent on a farm in Champaign County with a 130 SPI would be $293 per acre (-181.5 + 3.46 x 130 PI + $25 CRD adjustment). These estimates should only be viewed as a guide, additional factors beyond SPI and location can impact the appropriate rent for farmland, as discussed below.

Actual farm-level cash rents exhibit large variations from the above averages. For example, 60% of the rents on McLean County farms enrolled in Illinois Farm Business Farm Management (FBFM) in 2019 were within a range from $214 to $287 per acre. Note that the remaining 40% of the rents were outside that $73 per acre range. Rent variations often are due to the farm’s characteristics, including soil productivity, drainage, land access, land terrain, field size, and field obstructions. The desires of landowners and characteristics of the relationship between the landowner and tenant also play a large role in rent levels.

Annually, the Illinois Society of Professional Farm Managers and Rural Appraisers (ISPFMRA) conducts a mid-year survey to ask its members about cash rent expectations in the upcoming year. This mid-year survey is part of the Society’s land value effort, which produces a land value booklet each year, giving farmland prices and rental information by regions of the state (click here for an archive of reports).

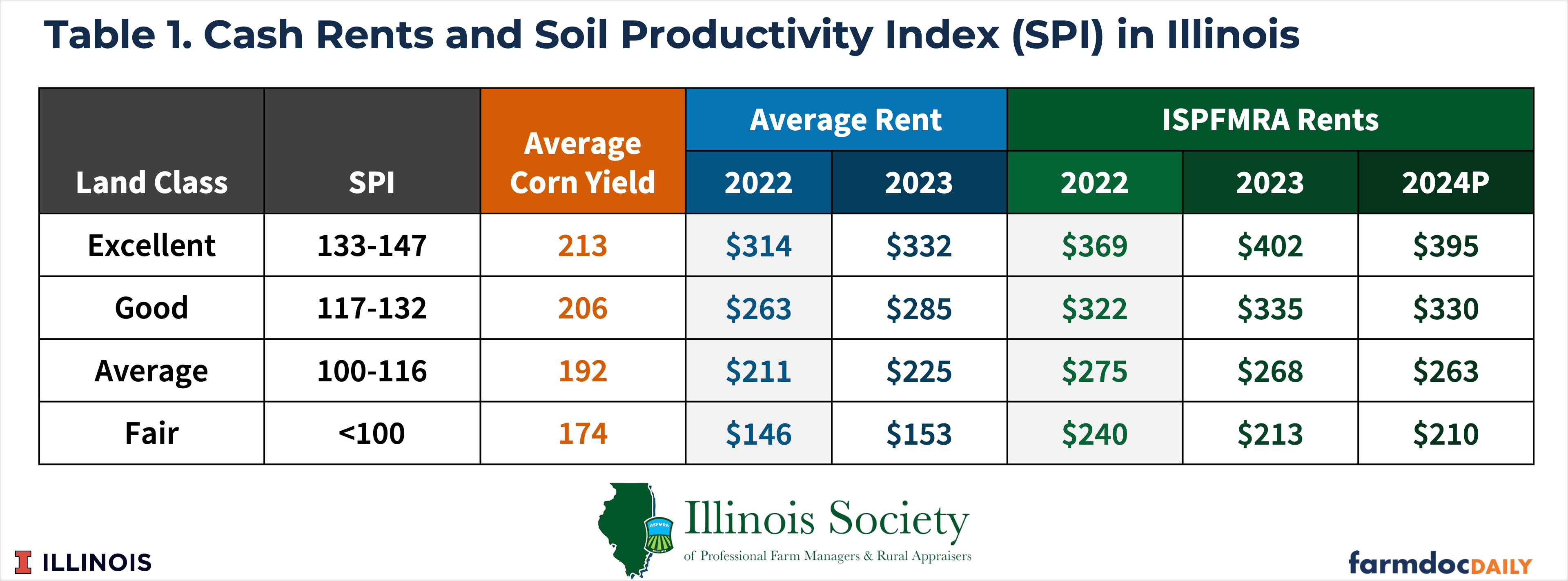

The ISPFMRA reports cash rents by four land classes: excellent, good, average, and fair. Land class divisions are made based on SPI ratings, with excellent farmland having SPIs ranging from 133 up to 147. SPI ranges for the remaining classes are shown in the first column of Table 1. Average corn yields vary by land class. For example, corn yield averaged 213 bushels per acre from 2018 to 2022 for counties that had average SPIs over 133 (see Table 1). The average corn yields over the same time period were lower for other classes: 206 bushels per acre for the good land class, 192 for the average land class, and 174 for the fair land class.

In 2023, the ISPFMRA reported an average rent for excellent quality farmland that is professionally managed of $402 per acre, an increase of $33 per acre compared with 2022. The average for Good quality land in 2023 increased by $13 per acre from the previous year. Average ISPFMRA rents for 2023 were lower than in 2022 for both the Average and Fair land classes.

As with all rents, there is a considerable range around the averages. For counties with SPI’s above 133, the average of 2023 cash rents reported by NASS was $332 per acre. Professionally managed farmland had a $70 per acre higher average cash rent. Similar relationships exist for other land classes:

Overall, professionally managed farmland tends to have higher average cash rents than NASS averages. A variety of reasons can be given for this difference, including the desires of farm owners who seek professional management for higher returns.

Professional managers of farmland are indicating that cash rents will decline slightly across all classes in 2024. Expected average rents by land class for 2024 are:

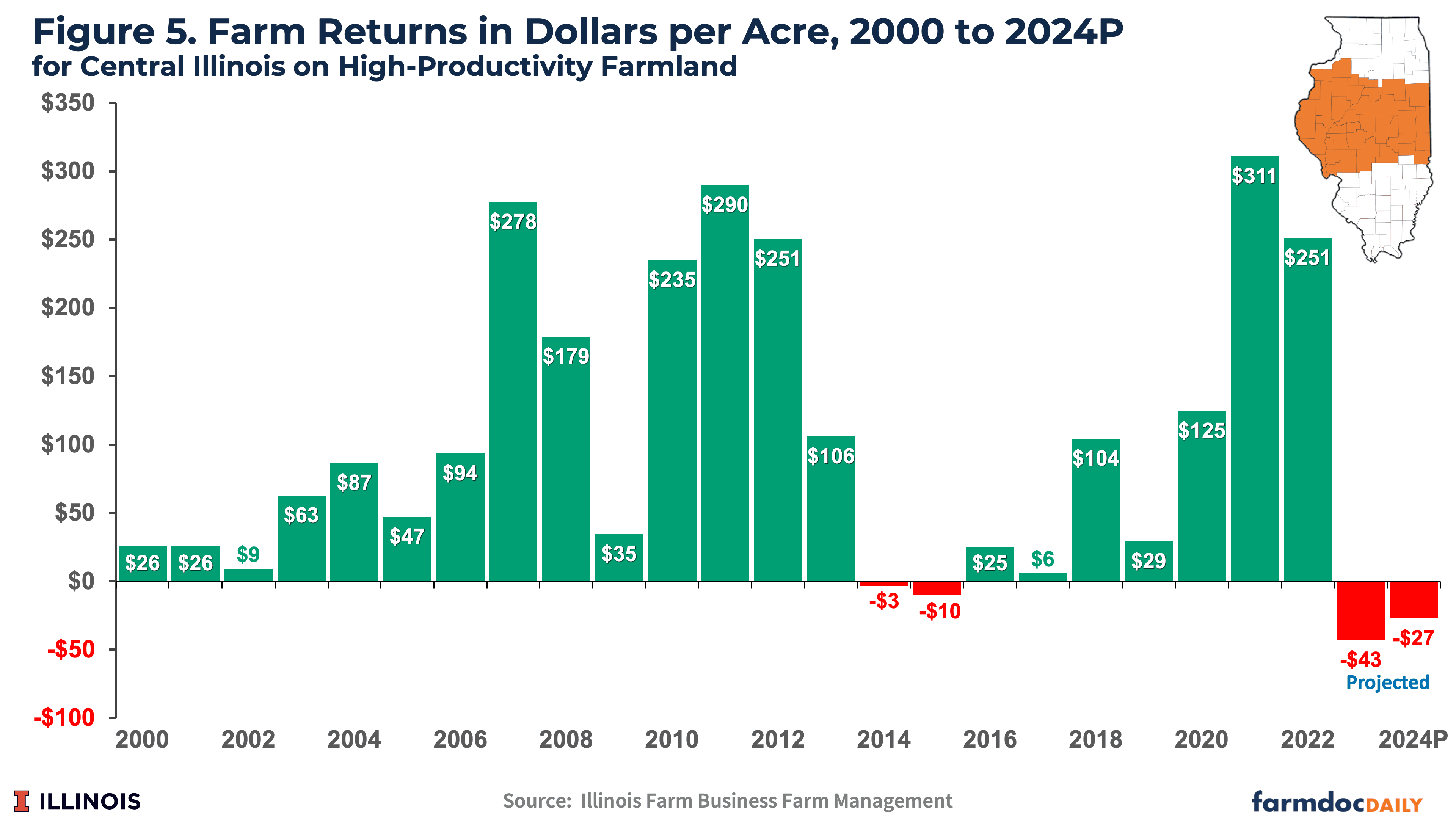

Average rent levels tend to follow trends in farm returns, but with a 1 to 2 year lag. While returns declined in 2023, most average rents continued to reflect the high return levels from 2020 to 2022. The moderate decline expected for 2024 reflects the lower returns expected for 2023 as well as expectations that 2024 returns will also be lower than in 2020-2023 (see Figure 5). More detail on current return projections and crop budgets in Illinois for 2024 were released on farmdoc daily last week (August 29, 2023).

The USDA recently released 2023 cash rents by county. Those rates, along with recent farm returns, provide information which can aid in setting 2024 cash rents. Typically, periods of higher returns quickly lead to higher cash rents. In contrast, cash rents are generally “sticky” or slow to decline in periods of lower cash returns. The projected 2023 and 2024 farmer returns are currently negative, reflecting a significant shift from the high farmer returns achieved in 2020, 2021, and 2022.

Consistent with these return expectations, professional farm managers also expect lower cash rents in 2024. However, larger adjustments may be needed to achieve positive return levels in 2024. At trend yields, projected break-even prices for the 2024 crop year across all regions of Illinois exceed $5.00 per bushel for corn and $12.00 per bushel for soybeans (see farmdoc daily August 29, 2023).

Schnitkey, G. "Determining the Average Cash Rent Based on Productivity Index." farmdoc daily (7):205, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 7, 2017.

Schnitkey, G., K. Swanson, N. Paulson, C. Zulauf and J. Baltz. "Information for Setting 2023 Cash Rents." farmdoc daily (12):140, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 13, 2022.

Schnitkey, G., N. Paulson, C. Zulauf and J. Baltz. "2024 Crop Budgets." farmdoc daily (13):157, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 29, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.