Nearly every year, two things increase: Your Social Security benefit, and your Medicare Part B premium.

So what happens if your Medicare premiums increase by more than how much your Social Security benefit increases? And can you actually see a decline in your monthly Social Security benefits?

Unfortunately, the answer is yes… if you’re not covered by the Medicare Hold Harmless provision.

Every year I release a new video on my YouTube channel and talk about the annual Social Security cost-of-living adjustments. And every year, I always see comments that suggest the Medicare Part B premium, which comes out of your Social Security check before you receive it, will increase to the point where the cost-of-living adjustment (or COLA) will have no effect.

In other words, people claim that the net result of both adjustments is that for some people, their benefit amount won’t increase at all. Some even think that their benefit will go down because of the increased Part B premiums.

So I wanted to take just a moment and talk about a special rule that protects most people from these increases. I’ll also explain who is not protected under this rule and how you can get protected if you see big premium increases coming.

The rule is commonly referred to as the Medicare Hold Harmless provision, but the official title is the Variable Supplementary Medical Insurance Premium. (We’ll just call it Hold Harmless provision in this article for simplicity’s sake.)

Before we dive into how this rule works, let’s look at the basics for just a moment and make sure we all understand how Social Security benefits and Part B premiums work together. As another way to help us avoid getting too convoluted, note that we’re not looking at Part D premiums here; the rules for that are a little different.

How Social Security Benefits and Medicare Part B Work Together

If you are 65 and on Social Security, your Medicare Part B premiums are automatically deducted from your benefits check before it ever arrives into your account. If you’re 65 and not drawing Social Security, you probably receive a quarterly bill (and if not, then it’s monthly) for Medicare.

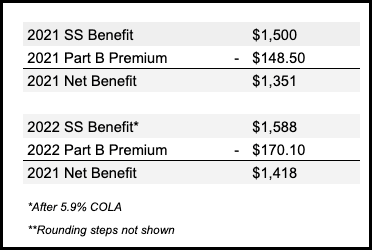

For example, if your 2021 Social Security benefit was $1,500 and your Medicare premium was $148.50 (which was the 2021 Part B premium amount), the net benefit that you receive would be $1,351.

Every October, annual COLA changes are announced and Social Security benefits usually go up as a result. In 2022, benefits went up by 5.9%.

If we continue our example of a $1,500 benefit, that means your check would see an increase of about $88. The adjustment would bring your total monthly benefit amount (before Medicare) to $1,588.

Remember that Medicare premiums change, too, and in 2022, monthly Part B Medicare premiums increased by $21.60. That increased the total monthly premium amount from $148.50 to $170.10.

This means that the net Social Security benefit increase you would see into your account would be $1,418, or an increase of $66 per month.

But what would happen if Social Security benefits didn’t increase at all, but Medicare premiums did?

Can Medicare Costs Wipe Out Social Security Benefits Increases?

It is completely possible that increases in Medicare would eat away at any potential increase of Social Security benefits. The Social Security cost-of-living adjustment is based on the Consumer Price Index (CPI-W), a measurement of general price levels for the things we buy. But Medicare premiums are calculated to where the premium coming in is supposed to cover 25% of the program’s cost.

So if we experience a year in which healthcare costs rise faster than general inflation, you could see a bigger increase in Medicare premiums than you did in Social Security benefits.

So if Social Security benefits don’t increase but Medicare premiums do, does that mean you receive a lower Social Security benefit than you did in the prior year?

Well, the short answer is no for most people. The Hold Harmless provision says that the net amount of a Social Security check cannot decrease due to rising Part B premiums.

Examples of How the Hold Harmless Provision Can Work in Real Life

Now, if you were covered by the Hold Harmless provision, your premium would have stayed the same. That means that your net Social Security benefit remains unchanged.

That’s the basic rundown of the Hold Harmless provision. But this still leaves big questions, like who is covered by the provision… and what happens in the next year after the Hold Harmless protection is activated? Will the premiums go up then?

Well, I’ll cover who is and is not covered by this rule in just a moment. But the other thing to remember about the Hold Harmless provision is that it doesn’t permanently reduce your monthly Medicare premiums.

If a future year increase to Social Security benefits happens to exceed the increase in Medicare cost, then you must make up the difference with additional Medicare premium boosts that you were able to just temporarily avoid because of that Hold Harmless rule.

Now, I want to walk through an example so you’ll see exactly how this would work. Let’s assume that in 2020, your Social Security benefit is $1,500 per month and you pay $144.60 in monthly Medicare premiums. This would give you a net benefit of $1,355 per month.

Let’s say that inflation is flat and there is no change to Social Security benefits from 2020 to 2021. However, the Part B Medicare premium did increase by $20, all the way up to $164.60. Now, since Social Security benefits didn’t increase but Medicare premiums did, it would seem that your net Social Security benefit would go down, but this is where the rule kicks in and your premium would stay the same.

But say from 2021 to 2022, things are flip-flopped. Inflation is higher and Social Security benefits increase by 3% because of COLA… but Medicare premiums don’t increase at all. In this case, the Social Security Administration will look at the prior year’s increase to see if it would cause a reduction in your net Social Security benefit.

Since it would not in this example, your Medicare Part B premium would increase to catch up with the prior year’s increase.

Now, when looking at these scenarios, there are thousands of possible combinations that we could run. But the important thing to remember is that your net benefit cannot decrease, but eventually those Part B increases will probably work their way into your benefit.

Is Everyone Covered by the Hold Harmless Provision?

There are two distinct types of individuals who are not covered by this rule:

1. Individuals who are on Medicare, but do not receive Social Security benefits: The rules say that you have to be entitled to Social Security benefits for the months of November and December, and have your Medicare premiums deducted from those benefits to qualify for the hold harmless rule.

Otherwise, your Medicare premium is going to increase to whatever it has been set for the new year.

2. Individuals who are classified as high income and subject to the income-related monthly adjustment amount (IRMAA).

This is also known as IRMAA. IRMAA is based on a two-year lag and modified adjusted gross income. And thankfully, we are seeing these thresholds for the IRMAA increase again, in response to inflation.

For 2023, that threshold is $97,000 for single individuals and $194,000 for those who are married and filing jointly. Keep in mind, there is a two year lag so this income level is based on your 2021 income. If that income surpassed that threshold amount, you would not be protected by the hold harmless provision in 2023.

If you’re one of the people who are not covered by the Hold Harmless agreement, pay attention to this.

Medicare premiums are calculated to cover 25% of the cost of the Part B program. The other 75% is paid by the government from the taxes you paid while you were working.

So when Medicare calculates their new premium for the next year, they take into account who is held harmless and who is not. Remember, the net result of the premiums coming in needs to be 25% of the part B program cost.

So if you have a year with a large increase in premiums, and a majority of beneficiaries are held harmless, those who are not held harmless would have to pay a disproportionate share of that increase.

This happened in the first part of the 2010s, when there was no Social Security cost-of-living adjustment to benefits. Social Security benefits didn’t increase, but Medicare Part B premiums did.

That increase had to be carried by those who were not protected by the Hold Harmless provision. The result was a 14.6% increase in Medicare premiums. Just a few years later in 2015, this topic came up again because the early forecast for the 2016 Part B premiums were looking for a 52% increase, which would have been $55 a month for those who are not held harmless.

Ultimately, this is why your retirement plan needs to be constantly evolving.

If you get to a year where this is going to be an issue, it could make sense to file for benefits and get protection from this rule. The changes for the year ahead are typically announced in October, and you only have to be entitled to benefits for November and December. So effectively, you’d have about a month to plan and get this together to decide if this made sense for you.

This is a multi-pronged issue that needs to be addressed with skill and an eye on the big picture. I wholeheartedly recommend getting help with this decision from a financial planner who is experienced in working with higher income clients who may be subject to the IRMAA.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 400,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.